Client Accounting Services (CAAS) Overview

TABLE OF CONTENTS

- Introduction

- Core Components of Outsourced Accounting

- Role of Technology in CAAS

- Advantages of Outsourcing

- Selecting the Right Provider

- Integrating CAAS into Your Business

- Future Trends in Client Accounting and Advisory Services

- Is Outsourced Accounting Right For Your Business?

- Frequently Asked Questions

Client Accounting & Advisory Services (CAAS), refers to a range of financial and accounting services provided by accounting firms to their clients. It focuses on managing and handling the financial affairs of clients. These services can vary based on the specific needs of the client but commonly include bookkeeping, payroll processing, financial reporting, and general financial advisory.

In the rapidly changing business landscape, the role of accounting and financial advisory has become more critical than ever. The increasing complexity of regulatory environments, the need for real-time financial data, and the drive for operational efficiency have made CAAS an essential component for business success. CAAS providers leverage advanced technologies, such as cloud-based accounting software and data analytics, to offer timely insights and strategic advice that help businesses navigate financial challenges, capitalize on opportunities, and make informed decisions.

Evolution of Accounting Services to Advisory

The evolution from traditional accounting to advisory services reflects the changing needs of businesses and the growing complexity of the financial landscape. Initially, accounting services were transactional in nature, focusing on record-keeping, tax preparation, and compliance reporting. However, as businesses sought more value from their accountants, the industry shifted towards a more consultative role.

This transition involves:

- From Historical Reporting to Forward-Looking Insights – Moving beyond just reporting past financial performance to providing forecasts, budgeting, and predictive analysis.

- From Compliance to Strategic Partnership – Accountants are no longer seen just as compliance officers but as strategic partners who contribute to business planning and decision-making.

- From Data Entry to Data Analysis – The focus has shifted from manual data entry and bookkeeping to leveraging technology for data analytics, offering deeper insights into business operations, efficiency, and profitability.

A provider acts as a comprehensive partner to businesses, offering not just accounting expertise but a strategic advisory role. This evolution reflects a broader understanding that financial success and business strategy are deeply intertwined, requiring a holistic approach to manage effectively.

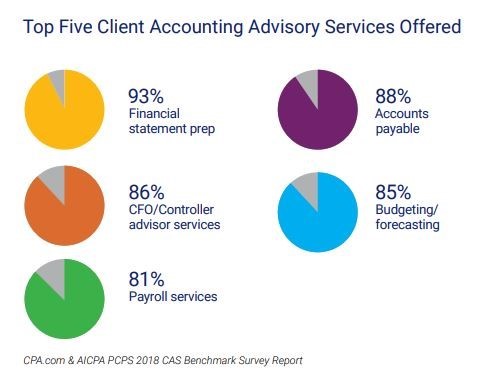

CAAS encompasses a comprehensive suite of services designed to help businesses manage their finances more effectively and strategically. Below are the core components that form the foundation of CAAS:

Bookkeeping and Accounting

This fundamental component involves the systematic recording, categorizing, and reconciling of financial transactions. It ensures accuracy in financial documents and compliance with legal and regulatory standards. It helps maintain accurate financial records, supports informed decision-making, and provides a clear picture of the business’s financial health.

Financial Reporting and Analysis

Involves the preparation of financial statements, such as income statements, balance sheets, and cash flow statements, followed by comprehensive analysis to interpret financial health and performance. Enables stakeholders to make informed decisions based on the business’s financial status, trends, and potential risks and opportunities.

Budgeting and Forecasting

Budgeting is the process of creating a plan to spend money over a specified period, based on projected income and expenses. Forecasting extends this by predicting future financial conditions and performance based on historical data and analysis. Assists in strategic planning, resource allocation, and financial goal setting. Forecasting helps anticipate future financial needs and challenges, enabling proactive decision-making.

Cash Flow Management

Focuses on monitoring, analyzing, and optimizing the inflows and outflows of cash. Effective cash flow management ensures that a business has enough cash to meet its obligations and avoid liquidity issues. Critical for maintaining solvency, supporting day-to-day operations, and planning for growth without overextending financial resources.

Tax Planning and Compliance

Involves strategizing to minimize tax liabilities within the legal framework while ensuring compliance with tax laws and regulations. It includes tax return preparation, deduction optimization, and staying abreast of changing tax codes. Helps businesses save money through efficient tax planning and avoid penalties associated with non-compliance, thereby protecting profits and facilitating legal operations.

Payroll Services

These components are interrelated and collectively support the financial management and strategic planning efforts of a business. By leveraging CAAS, businesses can ensure the accuracy and compliance of their financial operations and gain valuable insights and guidance to drive growth and enhance profitability.

ROLE OF TECHNOLOGY IN OUTSOURCED ACCOUNTING

The role of technology is pivotal, as it transforms traditional accounting processes and brings about various advantages. Here are key aspects highlighting the role of technology in CAAS:

Cloud Accounting Software Solutions (CAAS)

Cloud-based accounting software allows users to access financial data from anywhere with an internet connection. This enhances collaboration among team members, especially in a remote or distributed work environment. CAAS provides real-time updates, ensuring that financial data is always current. This facilitates faster decision-making processes as stakeholders have access to the latest information.

Automation and AI in Accounting

Automation of routine and repetitive accounting tasks improves efficiency and reduces the risk of human errors. AI algorithms can analyze large datasets quickly and accurately, enhancing the speed and precision of financial processes. By automating manual tasks, organizations can reduce labor costs and allocate resources more strategically. This allows accounting professionals to focus on more complex and value-added activities.

Data Analytics for Business Insights

Data analytics tools integrated with CAAS enable organizations to perform predictive analysis, helping forecast future trends and make informed business decisions. Businesses can monitor key performance indicators (KPIs) and financial metrics more effectively, leading to proactive decision-making and better financial management.

Cybersecurity and Data Protection

With sensitive financial data being stored in the cloud, robust cybersecurity measures are crucial. CAAS providers implement encryption, authentication, and other security protocols to ensure data integrity and protect against unauthorized access. CAAS platforms often adhere to industry standards and compliance regulations, providing a secure environment for financial data. Regular updates and audits help maintain the integrity of cybersecurity measures.

ADVANTAGES OF OUTSOURCING ACCOUNTING

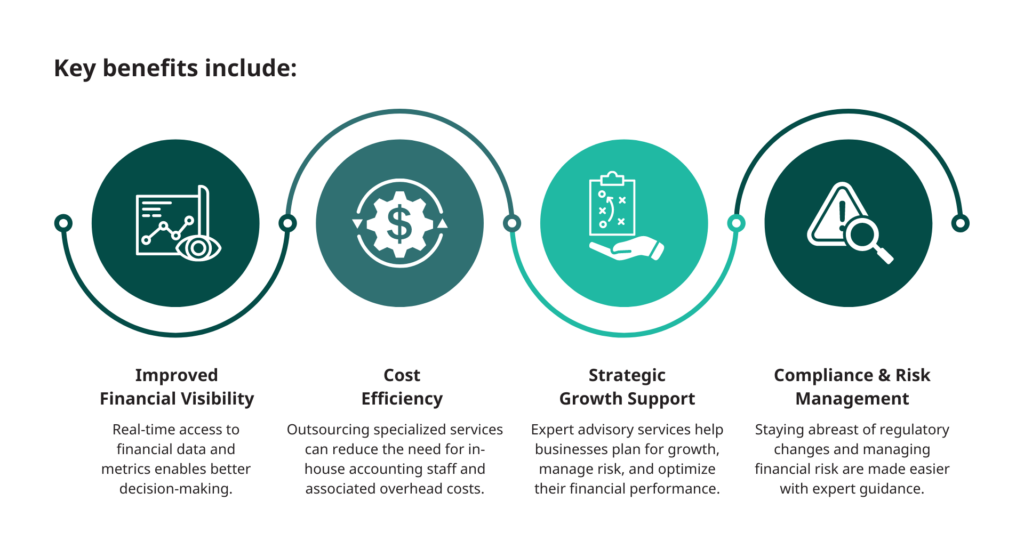

Outsourced Accounting offers several advantages for businesses looking to streamline their financial processes. Here are key benefits:

Cost Efficiency and Scalability

Outsourcing CAAS can lead to significant cost savings for businesses. External service providers often operate in regions with lower labor costs, allowing organizations to access skilled accounting professionals without the overhead expenses associated with in-house teams. Outsourcing allows businesses to scale their accounting operations based on fluctuating needs. Whether it’s expanding or contracting, outsourcing provides flexibility in adjusting the level of accounting services required.

Access to Expertise and Advanced Technologies

Outsourcing firms often have specialized expertise in accounting and financial management. This means businesses can benefit from the experience and knowledge of professionals who are well-versed in the latest accounting standards and practices. Outsourcing partners typically invest in advanced accounting technologies and software. This ensures that businesses leveraging these services have access to state-of-the-art tools and systems without the need for substantial upfront investments.

Enhanced Financial Decision-Making

Outsourcing CAAS can result in more timely and accurate financial reporting. External experts are dedicated to maintaining up-to-date and precise financial records, providing businesses with the information they need for informed decision-making. Outsourcing partners may offer valuable insights derived from data analytics and financial expertise. This can contribute to strategic financial planning and help businesses make informed decisions that align with their overall objectives.

By outsourcing CAAS, businesses can free up internal resources to focus on core competencies and strategic initiatives. This allows for a more concentrated effort on activities that directly contribute to the growth and success of the business. Accounting and financial management tasks can be time-consuming. Outsourcing allows businesses to offload these administrative burdens, enabling internal teams to concentrate on tasks that require their specific skills and attention.

SELECTING THE RIGHT OUTSOURCED ACCOUNTING PROVIDER

Selecting the right Client Accounting and Advisory Services (CAAS) provider is critical for businesses seeking efficient and effective financial management. Here are key considerations for choosing the right CAAS provider:

Criteria for Selection – Evaluate the provider’s expertise in accounting and financial management. Look for certifications, industry recognition, and client testimonials that demonstrate their proficiency in delivering CAAS solutions. Assess the provider’s technology infrastructure and software capabilities. Ensure that their platform is scalable, secure, and equipped with features that meet your business needs, such as automation, integration with other systems, and customizable reporting functionalities. Consider the range of services offered by the provider. Determine whether they offer comprehensive accounting solutions that align with your business requirements, including bookkeeping, financial reporting, tax compliance, and advisory services.

Understanding the Service Agreement – Carefully review the service agreement and terms of engagement before committing to a CAAS provider. Pay attention to key provisions such as service levels, pricing structure, data ownership and security, confidentiality clauses, and dispute resolution mechanisms. Clarify any ambiguities or concerns with the provider to ensure mutual understanding and alignment of expectations. It’s essential to have clear communication channels and a transparent relationship to foster trust and collaboration throughout the engagement.

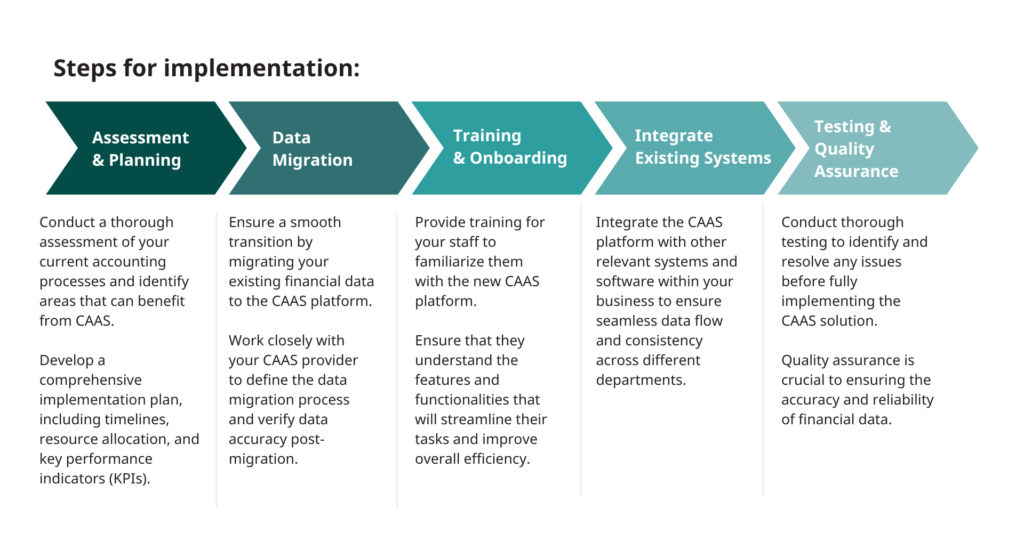

Integrating Cloud Accounting Software Solutions (CAAS) into your business involves a strategic and well-planned approach. Here are steps for implementation, tips for collaborating with a CAAS provider, and insights from case studies:

Collaborating with a CAAS Provider for Optimal Results

Establish clear communication channels with your CAAS provider. Regularly communicate your business goals, expectations, and any specific requirements you may have. Schedule regular reviews with your CAAS provider to assess the performance of the system, address any issues, and explore opportunities for optimization or additional features. Work collaboratively to address challenges and find solutions. A strong partnership with your CAAS provider can lead to continuous improvement and a more effective implementation.

- MK Industries Case Study – When new owners take over a business, the existing CPA relationship doesn’t always survive the transition. In 2013, Rick DeLuga and Glenn Smith purchased MK Industries from the original owners and KRD has continued to advise them. “KRD is conservative by nature like we are, and since they had been with the business so long, they knew who we are and how we operate,” Glenn said. “Plus, we don’t look good in stripes or orange, and they help us understand the pitfalls as owners of a business operating in multiple states.”In fact, KRD supported the company through every growing pain and the transition of its three original owners, two of whom were brothers. As president of the company, Rick preferred an independent controller relationship to oversee in-house staff and to be an extension of the executive team for consistent communication.

FUTURE TRENDS IN CLIENT ACCOUNTING AND ADVISORY SERVICES

The landscape of Client Accounting and Advisory Services (CAAS) is evolving rapidly, driven by technological advancements, changing business dynamics, and regulatory shifts. Here are some future trends in CAAS:

Predictive Analytics and Strategic Advising

The integration of predictive analytics tools into CAAS platforms allows accounting professionals to analyze historical data and predict future trends. This enables them to offer more proactive and strategic advice to clients. Predictive analytics can assist in scenario planning, helping businesses anticipate potential challenges and identify opportunities. This strategic advising based on data insights enhances the value that accountants bring to their clients.

The Growing Importance of ESG Reporting

With increasing emphasis on sustainability and responsible business practices, ESG reporting is becoming integral to corporate transparency. CAAS providers will likely incorporate ESG metrics and reporting functionalities to help businesses measure and communicate their environmental and social impact. CAAS professionals will be crucial in guiding clients through evolving ESG reporting standards and ensuring compliance with regulatory requirements. This includes helping businesses measure and report their sustainability efforts accurately.

Regulatory Changes and Compliance Challenges

The regulatory landscape is dynamic, and CAAS providers must stay abreast of changes in accounting standards, tax regulations, and compliance requirements. This involves proactive monitoring and timely adaptation to ensure clients remain compliant. CAAS platforms will likely incorporate advanced compliance tools that leverage automation and AI to simplify compliance processes. This can help businesses navigate complex regulatory environments more efficiently.

Remote Collaboration and Digital Transformation

The trend toward remote work will likely persist, requiring CAAS providers to enhance remote collaboration capabilities within their platforms. Cloud-based solutions and secure communication channels will become even more crucial. CAAS providers and their clients will increasingly embrace digital transformation initiatives. This includes adopting integrated technologies, such as document management systems, electronic invoicing, and automated workflows, to enhance efficiency and reduce manual processes.

CAAS providers will focus on offering more personalized and customized advisory services to meet the specific needs of individual clients. This may involve leveraging AI to understand client preferences and delivering targeted insights. CAAS platforms will be designed to scale and adapt to the unique requirements of businesses, providing flexibility in service delivery to accommodate both small businesses and large enterprises.

IS OUTSOURCED ACCOUNTING RIGHT FOR YOUR BUSINESS?

Readiness Checklist

- Current Financial Management Challenges

- Are you facing difficulties in keeping up with bookkeeping and financial reporting?

- Is your current accounting system inefficient or outdated?

- Have you experienced financial discrepancies or compliance issues?

2. Internal Resources and Expertise

- Do you lack in-house accounting expertise or resources?

- Is your internal team overwhelmed with the current workload?

- Would your business benefit from access to specialized accounting knowledge and skills?

3. Business Growth and Scalability

- Is your business growing or planning to scale, requiring more sophisticated financial management?

- Do you need better financial insights and reporting to inform strategic decisions?

- Are you looking to streamline operations and reduce overhead costs?

4. Technology and Integration

- Are you seeking to modernize your financial systems with cloud accounting and automation?

- Do you require better integration between your accounting system and other business operations?

- Is data security and compliance a major concern for your financial data?

5. Customization and Flexibility

- Do you need a flexible, customized accounting solution tailored to your specific business needs?

- Are you looking for advisory services beyond just transactional accounting tasks?

6. Cost Considerations

- Have you analyzed the cost-benefit ratio of outsourcing versus maintaining in-house accounting?

- Are you prepared for the financial commitment required for a quality CAS provider?

Deciding to adopt Client Accounting Services is a strategic choice that can offer significant benefits in terms of efficiency, insight, and scalability. By carefully considering these aspects, you can ensure that CAS aligns with your business objectives and will support your growth and success in the long term.

FREQUENTLY ASKED QUESTIONS

Below are some frequently asked questions (FAQs) about Outsourced Accounting along with brief answers:

1. What is Client Accounting and Advisory Services (CAAS)? – CAAS refers to a suite of accounting services that go beyond traditional bookkeeping. It includes financial management, and strategic advisory, and often leverages technology to provide clients with comprehensive insights into their financial health.

2. How is CAAS different from traditional accounting services? – CAAS extends beyond basic accounting functions, offering strategic advice, financial analysis, and leveraging advanced technologies. It focuses on providing actionable insights to help businesses make informed decisions.

3. What are the key components of CAAS? – Key components include real-time financial reporting, predictive analytics, strategic planning, technology integration, and often, a more collaborative and advisory-oriented relationship between the accountant and the client.

4. How does technology play a role in CAAS? – Technology is a cornerstone of CAAS, facilitating automation, data analytics, cloud-based solutions, and real-time reporting. It enables accountants to provide more efficient and proactive services to clients.

5. What benefits can businesses expect from adopting CAAS? – Businesses can expect benefits such as improved financial visibility, streamlined processes, cost efficiencies, strategic insights, and access to advanced technologies without the need for significant in-house investments.

6. Is CAAS suitable for small businesses, or is it more geared toward larger enterprises? – CAAS is adaptable and can be tailored to the needs of both small businesses and larger enterprises. It provides scalability, allowing businesses to receive services that match their size and complexity.

7. How does CAAS contribute to decision-making within a business? – CAAS provides businesses with real-time financial data, predictive analytics, and strategic advice. This enables informed decision-making by offering insights into cash flow, profitability, and potential risks or opportunities.

8. What role does the accountant play in CAAS? -Accountants in CAAS act not only as record-keepers but also as strategic advisors. They leverage technology to analyze financial data, provide insights, and guide clients in making decisions that align with their business goals.

9. Are there industry-specific considerations in CAAS? – Yes, CAAS providers with industry-specific experience can offer tailored solutions that address the unique challenges and regulatory requirements of different industries.

10. How can businesses ensure data security when using CAAS? – Choosing reputable CAAS providers with robust cybersecurity measures is crucial. Encryption, secure data storage, and compliance with industry standards are key factors in ensuring data security.

Contact Us

KRD CPAs provide outsourced accounting services to companies remotely from our Chicago office. Interested in learning more about our outsourced accounting and client accounting services? Complete the form below and a team member will follow up with you promptly?